What Does Eb5 Investment Immigration Mean?

What Does Eb5 Investment Immigration Mean?

Blog Article

3 Easy Facts About Eb5 Investment Immigration Explained

Table of ContentsThe Buzz on Eb5 Investment ImmigrationEb5 Investment Immigration Fundamentals ExplainedRumored Buzz on Eb5 Investment ImmigrationEb5 Investment Immigration Fundamentals ExplainedThe Eb5 Investment Immigration IdeasAn Unbiased View of Eb5 Investment Immigration

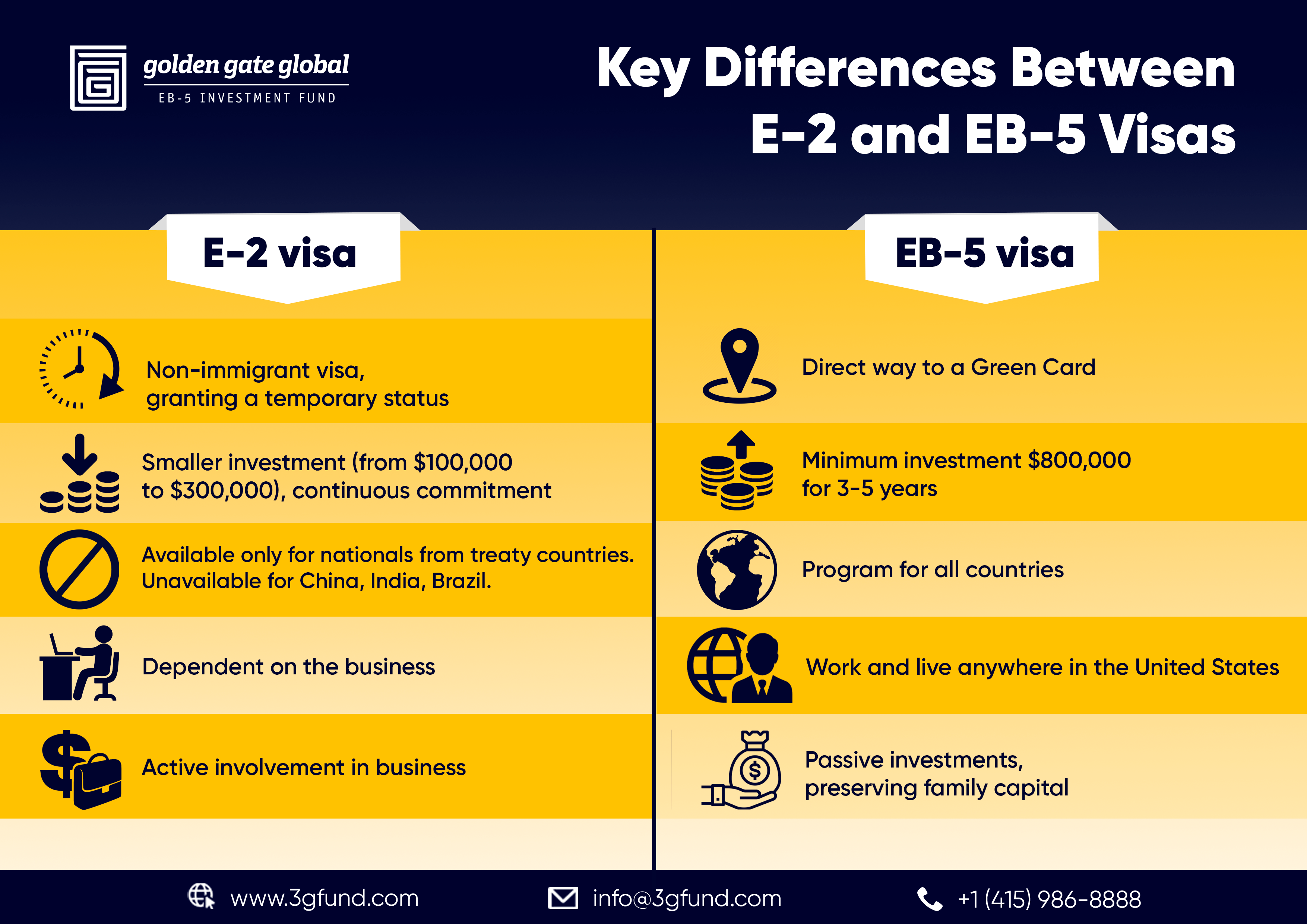

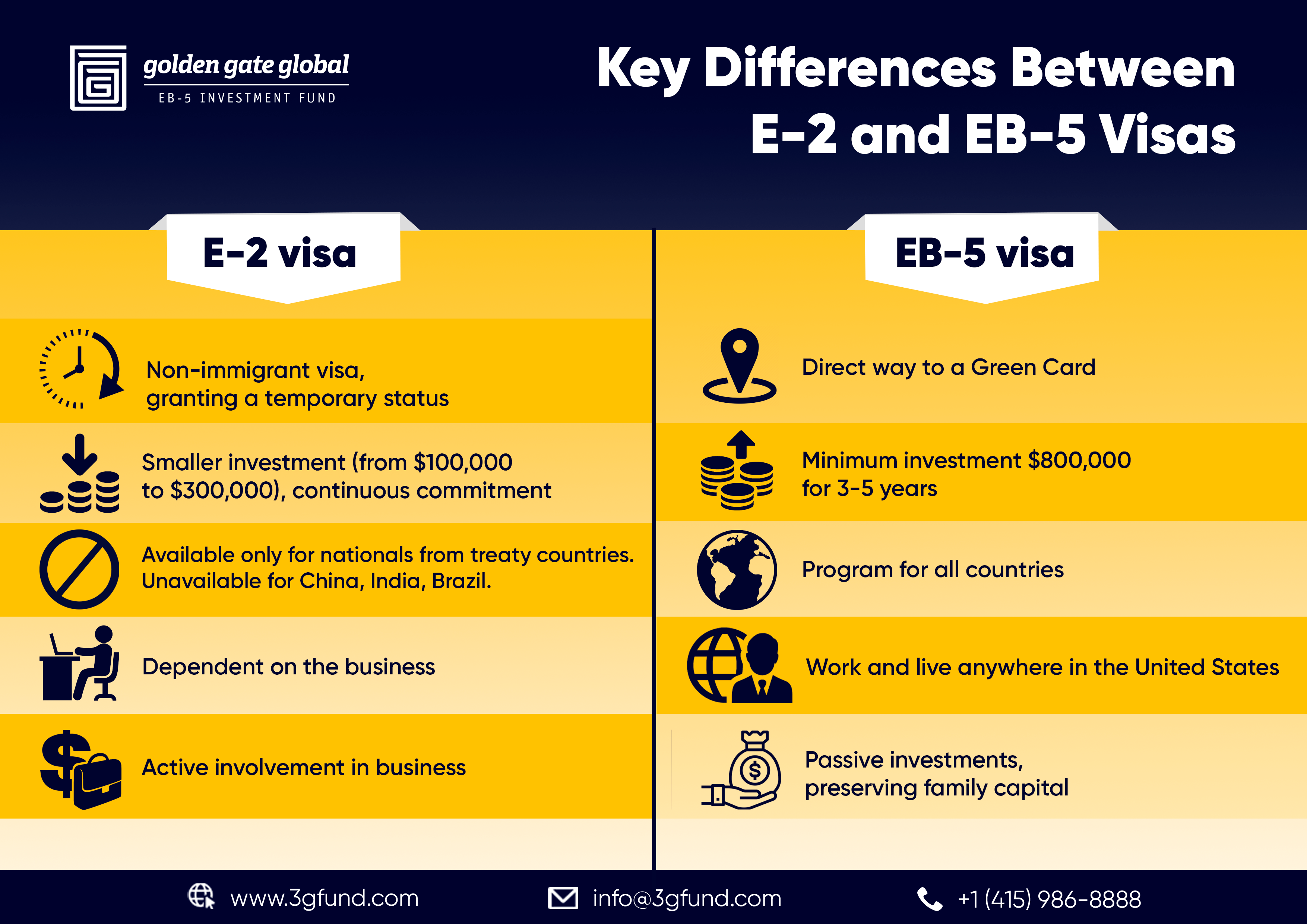

dollar fair-market worth. The minimum amount of funding needed for the EB-5 visa program might be lowered from $1,050,000 to $800,000 if the investment is made in a business entity that is situated in a targeted work location (TEA). To receive the TEA classification, the EB-5 task have to either be in a backwoods or in an area that has high unemployment.workers. These work must be developed within both year duration after the financier has gotten their conditional irreversible residency. Sometimes, -the financier needs to be able to confirm that their investment brought about the development of direct tasks for workers that work directly within the business entity that got the financial investment.

Regional focuses administer EB-5 projects. It may be extra useful for a capitalist to buy a regional center-run project because the capitalist will not need to individually establish up the EB-5 projects. Infusion of 8500,000 as opposed to $1,050,000 is not as cumbersome. Capitalist has more control over daily procedures.

Eb5 Investment Immigration Things To Know Before You Buy

Investors do not require to produce 10 tasks, but keep 10 currently existing settings. Company is already distressed; therefore, the investor might negotiate for a much better bargain.

Congress offers regional facilities top concern, which might indicate a quicker course to authorization for Type I-526. Financiers do not need to produce 10 direct work, however his/her financial investment needs to produce either 10 straight or indirect jobs.

The financier needs to reveal the creation of 10 work or perhaps even more than 10 tasks if expanding an existing organization. If service folds up within 2 year duration, financier might lose all spent capital.

Worsened by its area in a TEA, this company is already in distress. Must typically live in the exact same area as the venture. If company folds up within two year period, financier can shed all spent capital. Financier needs to show that his/her financial investment produces either 10 direct or indirect work.

The Best Guide To Eb5 Investment Immigration

Usually provided a placement as a Restricted Responsibility Companion, so capitalist has no control over everyday operations. In addition, the basic partners of the regional facility company usually gain from capitalists' investments. Capitalist has the alternative of buying any type of sort of enterprise throughout the U.S. Might not be as high-risk since investment is not made in an area of high unemployment or distress.

Financiers do not need to create 10 tasks, but have to instead preserve 10 already existing settings. Business is already troubled; thus, the capitalist may plan on a better offer. Capitalist has even more control over day to day procedures. EB5 Investment Immigration. Eliminates the 10 worker need, allowing the capitalist to certify without straight working with 10 individuals.

The investor needs to maintain 10 currently existing employees for a period of at least 2 years. If an investor see this page suches as to invest in a regional facility firm, it may be far better to spend in one that just requires $800,000 in investment.

The Best Guide To Eb5 Investment Immigration

Financier requires to show that his/her investment creates either 10 direct or indirect jobs. The basic partners of the local facility firm typically profit from investors' investments.

for two years. We check your financial investment and task development progression to make sure compliance with EB-5 needs during the conditional duration. We aid collect the essential documents to demonstrate that the needed financial investment and job development requirements have been met. Prior to expiry of the two-year conditional permit, we submit the I-829 request to eliminate conditions and anchor achieve permanent residency status.

Among the most important elements is ensuring that the financial investment stays "at risk" throughout the procedure. Understanding what this requires, in addition to investment minimums and how EB-5 financial investments satisfy permit qualification, is critical for any type of possible investor. Under the EB-5 program, capitalists should satisfy particular resources thresholds. Considering that the implementation of the Reform and Honesty Act of 2022 (RIA), the typical minimum investment has been $1,050,000.

TEAs include rural locations or regions with high joblessness, and they incentivize job development where it's most needed. No matter the quantity or category, the investment needs to be made in a brand-new business (NCE) and produce at least 10 full-time jobs for US workers for an EB-5 candidate to get residency.

Not known Factual Statements About Eb5 Investment Immigration

The investor needs to preserve 10 currently existing employees for a period of at least 2 years. If an investor suches as to spend in a regional center company, it might be much better to spend in one that just requires $800,000 in investment.

We monitor your financial investment and work creation progression to make certain compliance with EB-5 demands throughout the conditional period. We aid gather the essential paperwork to demonstrate that the called for investment and job production requirements have actually been satisfied.

Among one of the most important aspects is ensuring that the investment stays "at risk" throughout the procedure. Comprehending what this requires, along with financial investment minimums and exactly how EB-5 investments accomplish permit eligibility, is critical for any kind of prospective financier. Under the EB-5 program, investors should meet particular resources limits. Given that the enactment of the Reform and Integrity Act of 2022 (RIA), the common minimum investment has been $1,050,000.

Eb5 Investment Immigration Fundamentals Explained

TEAs consist of country locations or regions with high unemployment, and they incentivize work development where it's most needed (EB5 Investment Immigration). No matter the quantity or group, the financial investment should be made in a new company (NCE) and generate at the very least 10 full-time tasks for United States employees for an EB-5 applicant to qualify for residency

Report this page